Retention is the life blood of an independent insurance agency’s business. As agency owners consider planning, emphasis on new business generation often takes precedence over retention goals. Considering it costs a typical business five-to-seven times more to acquire a new client than retain an existing client, agency owners will benefit by allocating resources towards increasing renewable income.

Historically, many agents tracked policy retention. But policies really represent a transactional perspective. Today’s successful local independent insurance agency owner puts more emphasis on the long-term client relationship, understanding a client’s needs (and active policies) will change over the course of time. Beyond policy retention, agency owners benefit more by considering Client Retention and Average Revenue Per Client as key performance indicators (KPI) to track and measure.

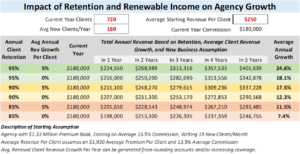

The chart below shows an example of how client retention and average revenue per client can impact overall agency growth. The illustration considers a small agency currently generating $180,000 commission revenue from 720 existing clients ($250 average revenue per client) that is adding 180 new clients per year (average 15/month). The first column shows various annual Client Retention assumptions (85%, 90%, and 95%) and the second column shows for each retention number an average annual client revenue growth of either 0% or 5%. This increase can come from rounding accounts (i.e., adding umbrella policies to a portion of existing clients) or increasing coverage (i.e., additional endorsements that might be worth a client adding).

As an example, let’s assume doing nothing this agency can maintain an 85% annual client retention with 0% average annual revenue growth per client (meaning the average revenue remains at $250 per client over the five-year period). Under this scenario, the agency writing 15 new client per month could grow about 7.4% per year over the next five years. However, if this same agency could achieve a 95% annual client retention and increase their average revenue per client 5% annually, under the same new business assumptions (15 new clients/month) that agency could grow about 24.6% per year. The revenue difference between these two scenarios in five years could be as much as $150,000 to the agency with the better retention and average revenue growth KPIs ($401,639 as compared to $246,755).

When the difference in revenue generated based on different KPI assumptions can be understood, it helps an agency owner determine how much time, effort and money should be invested in client retention and loyalty activities. Some of the things an agency owner may then ask themselves:

- Does the agency have an effective onboarding process for new clients that sets a strong foundation to improve the likelihood they remain with the agency long-term?

- Does the agency show appreciation for clients with thank-you cards, birthday/holiday emails, and regular communication?

- Is the agency proactive in handling client life changes (or regular account reviews) that may uncover additional needs (i.e., personal umbrella/liability, life insurance) that is available?

- Is the agency consistent in checking in with clients to understand how they feel about their active policies (coverage, price) or agency service?

- Do clients have access to their accounts (i.e., policy information, billing) through self-service capabilities?

- Do clients receive regular communications from the agency that goes beyond policy and billing action items (i.e., helpful tips, ways to save)?

While this is not an exclusive list, developing a process to effectively onboard new clients and maintain long-term loyalty should address these questions. The increase in digital tools makes many of the communications discussed above easier to accomplish. Effective retention plans may also include allocating a set amount of time specifically to client retention/loyalty, upgrading a current agency management system or purchasing client relationship management (CRM) software to automate the process, improving current website and communication capabilities, and/or contracting a third-party to manage part of the process. Regardless of the activities, understanding the potential revenue generation increases that can be gained by improving client retention and average client revenue KPIs will help an owner see the cost-benefit of investing in client loyalty and retention programs.

To learn more, contact our SIA of Northern Ohio team.